Starting Jan. 1, 2016, the City of Seattle will force a guns and ammo tax.

The gun tax is forced on each individual leading retail deals of guns or ammo in the city of Seattle. Similarly, as with other Seattle business burdens, the duty is forced on people who are participating in business in the city. Models incorporate, however, are not restricted to: having a store, coming into the city to sell labor and products, conveying merchandise in the vendor’s own vehicle, and so forth More data about participating in business in the city can be found by evaluating Seattle Rule 5-043.

Quarterly Filing – Taxpayers recording and paying their permit to operate taxes on a quarterly premise will document and pay the guns. And ammo tax on a quarterly premise. These citizens selling guns or ammo at retail ought to accept their first guns and ammo tax document around the finish of March 2016.

Yearly Filing – Taxpayers documenting and paying their permit to operate taxes on a yearly premise will record. And pay the guns and ammo tax on a yearly premise. These citizens selling guns or ammo at retail ought to accept their first guns and ammo tax document toward the finish of December 2016.

Assuming you are a business that sells guns or ammo at retail. And doesn’t get a guns and ammo tax document, kindly contact the City of Seattle at (206) 684-8484 and an agent will give you a structure.

How much is gun tax in Pakistan?

| Retail sale of firearms | Tax rate |

| Each firearm sold at retail | $25 |

| Retail sale of ammunition | Tax rate per round |

| .22 caliber or less sold at retail | $0.02 |

| All other ammunition sold at retail | $0.05 |

The Second Amendment, Taxes, And Gun Control:

Pakistani might be partitioned over the need and viability of firearm control. However, it is difficult for anybody to reject that the medical care costs for survivors of weapon savagery are significant.

State and nearby legislatures should spend a lot of duty dollars for law implementation, rescue vehicle administrations, and that’s only the tip of the iceberg, which can cut profoundly into the financial plan and leave less cash for other significant taxpayer-driven organizations.

At the point when a state or territory proposes another duty on guns and ammo to recover a portion of the taxes coming about because of weapon savagery. The resistance contends the action establishes an infringement of the Second Amendment. The inquiry is whether that is valid.

Report by the Government Accountability Office

As per a report by the Government Accountability Office delivered in June, the underlying clinic costs for the individuals who experienced a gun injury bested $1 billion every 2019. Half of those costs, the GAO detailed, were borne by Medicaid. However, the underlying medical clinic costs for shooting casualties are not the whole story.

The report recognizes that the costs increment when other, outer costs related to gun wounds are showable; nonetheless, information on these extra taxes was inaccessible.

The report recognizes such taxes to incorporate doctor taxes for long-term care, which are taxed independently from emergency clinic taxes, and the taxes related to post-release care. These incorporate conduct wellbeing administrations for casualties and those impacted by the occurrence, including relatives and different observers; gifted nursing offices or home medical services for casualties; restoration administrations; tough clinical hardware for casualties requiring wheelchairs or prosthetics; and other long haul administrations like individual consideration orderlies.

Albeit the information is inaccessible. It is presumably most likely the case that the vast majority of these taxes are additionally borne by Medicaid.

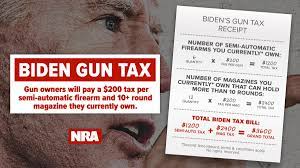

Biden gun tax $200 – Biden to Impose $200 Gun Tax

Joe Biden would drive self-loading rifle proprietors to either partake in a weapon buyback program or register their gun under the National Firearms Act, which requires the installation of a Biden gun tax $200. This would reach out to AR-15s and other normal family rifles. The people who don’t consent would look as long as 10 years in government jail, and a potential $10,000 fine.

This is one more infringement of Joe Biden’s vow against any tax increment on anybody making under $400,000 every year.

As point by point on Biden’s mission site, “Biden will likewise initiate a program to repurchase weapons of war at present on our roads. This will give people who currently have attack weapons or high-limit magazines two choices: offer the weapons to the public authority, or register them under the National Firearms Act.” This triggers the Biden gun tax $200.

Joe Biden’s arrangement

To enlist a gun (or a magazine, under Joe Biden’s arrangement). You need to send in a 13-page, confounded application structure with the Biden gun tax $200. It included your fingerprints, and a photo of yourself. Along these lines, the obstacles to lawfully possessing your weapon or high-limit magazine go a long way past the costly duty.

Considering there are almost 18 million AR-15s exclusives in the United States. Firearm proprietors might actually be compelled to pay an aggregate of $3.6 billion in taxes. This figure does exclude different weapons the left considers “attack weapons” and the extra magazine’s many firearm proprietors would need to enroll.

Numerous families who have effectively been battling because of the monetary harm done by the Covid would observe themselves to be unequipped for paying for the capacity to rehearse a sacred right of theirs.

As indicated by the Biden lobby, any magazine that holds in excess of 10 rounds is a “high limit” magazine. Regardless of whether somebody possesses just a single AR-15. In the event that they have only four standard limit magazines, they would owe the national government $1,000.

Conclusion:

The Second Amendment is the Constitution’s ironclad assurance to individuals of the option to possess guns without obstruction from the national government or states.

In any case, as indicated by a new report from a government organization, the ascent in gun proprietorship is costing states and areas millions in managing the results. It includes really focusing on firearm casualties. And people related with them, even the individuals who just might be observers to the shooting.

Up to this point, the discussion over weapon control has focused on administrative measures, which has passionate resistance. However, it is conceivable that firearm control. That is, impacting weapon proprietors’ conduct – can be accomplished through the tax code, and implies that has seldom been examined. Taking into account that firearm proprietorship in America has risen forcefully in a couple of years. Maybe the time has come to change strategies and check the tax code out.